Have you ever been organizing your credit card information, and needed a handy way to tell how long your cards have been open?

Have you ever been organizing your credit card information, and needed a handy way to tell how long your cards have been open?

For some reason, this question has come up a lot lately on some other blogs and forums that I visit regularly, and while there are a few ways to track down the date you opened a card, I wanted to share what I think is the easiest (screenshots and simple instructions included).

Organizing Your Credit Card Information

If you’re wondering where to even begin with organizing your information, the good news is that Brad has done most of the heavy lifting already. You should grab this simple spreadsheet that he and Laura used for their trip to Disney World. It’s very easy to modify this for your own tracking purposes. Then, as you’re filling it out, you’ll realize the need to keep track of the dates that your cards were opened.

Knowing these dates will help you know when annual fees come due, when you will earn anniversary nights, etc.

Potential Methods

The most obvious way to get this information is to call each credit card company in question, or send them a secure online message. This is straight from the source, but will take a fair amount of time. Imagine if you had cards from five different creditors. That would mean repeating the same process five different times. And in the case of calling, what happens if you write down the info and then lose it later?

Another option is to pull your credit report from annualcreditreport.com, the longstanding, FTC-backed website that provides a free copy of your report from each credit bureau every year.

That’s the most “official” way to check your credit report, for sure, but may not be helpful here. It’s a bit more tedious to log in and grab those reports (you have to go through extensive security questions, etc., and what if you’ve already used your freebie for the year?

The much simpler solution is to log in to Credit Karma. You may know that Credit Karma provides what are called FAKO credit scores. In other words, the scores aren’t calibrated exactly like FICO, which is what most lenders will use.

But their credit report imports work differently, and they have all the information from your credit reports, directly from TransUnion and Equifax.

This is perfect if you know all of the accounts you have and are just looking for the date you opened them. Again, if you were doing a full credit checkup of some sort, then annualcreditreport.com is best. But for simplicity and getting the answers you need quickly, you can’t go wrong here. Plus, you can always refer back to Credit Karma time and time again for free.

The Fast Method–Credit Karma Instructions

Just in case you aren’t familiar with the inner workings of Credit Karma, I’ll give you a quick how-to guide, with screenshots, of how you can go in and access the information you’ll need. When I did this recently, it took me a few minutes to find what I needed as it is a bit hidden deeper in your account than you might expect.

I should mention that I edited the information in the screenshots below, to retain my privacy, and because it felt super-satisfying to pretend that I have a perfect credit score, ha!

Step 1: Log In

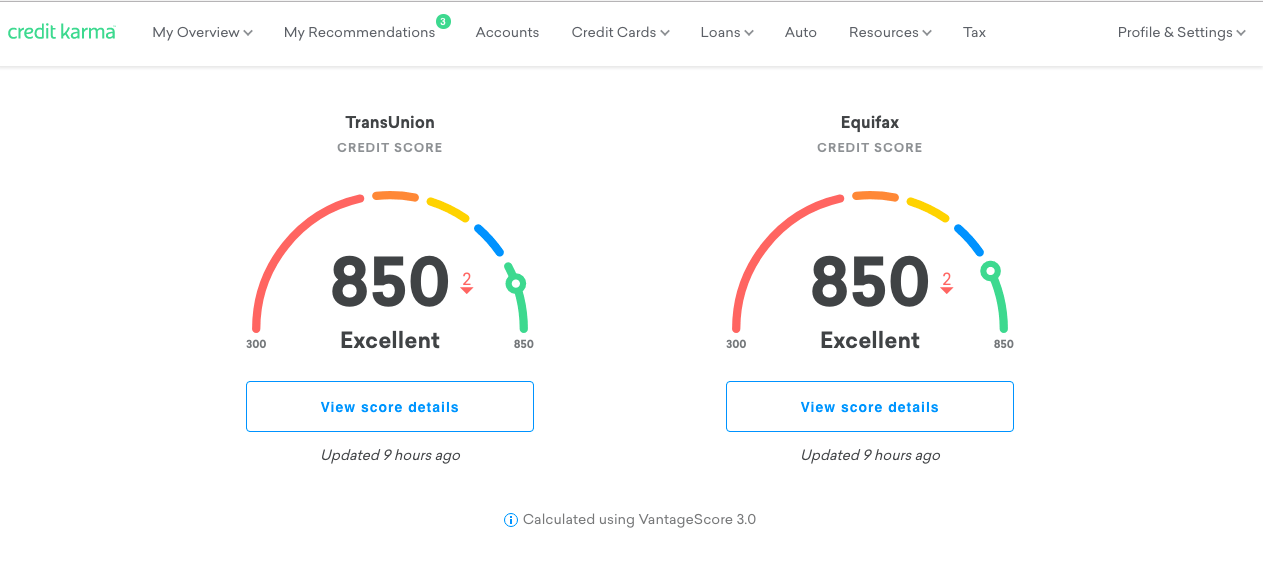

Log in to Credit Karma (obviously), and you’ll be brought to a screen like this:

Step 2: Click “Accounts”

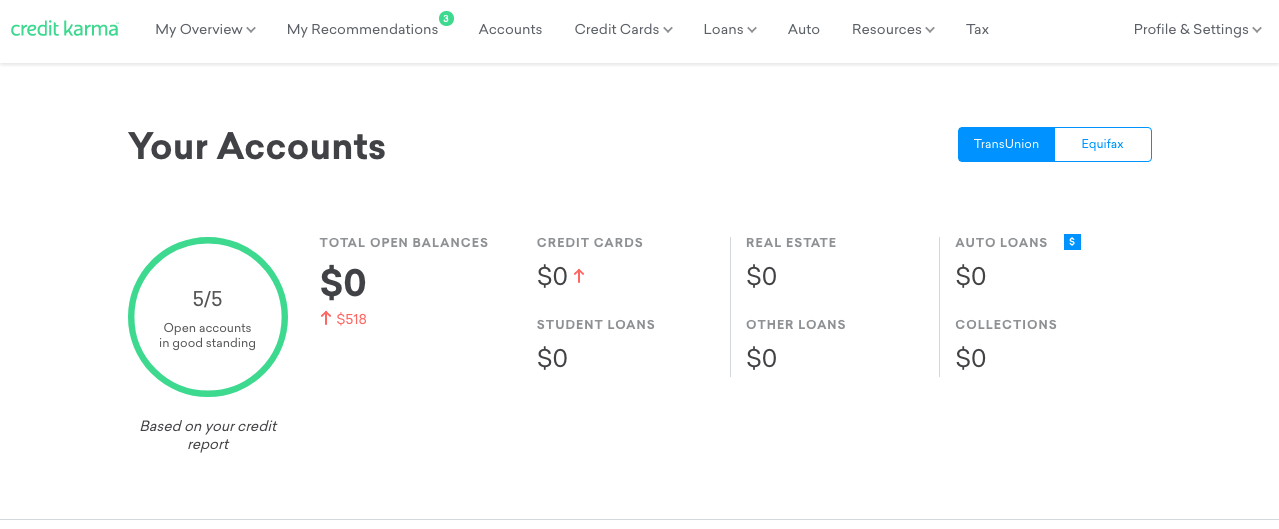

Click the “Accounts” tab in the top menu (if you don’t see it, skip to the alternate step below), and you’ll arrive at this screen:

Then, scroll down and you’ll see a full list of accounts for the selected credit bureau. If you scroll back to the top of the Accounts page, you’ll see an option to toggle between TransUnion and Equifax.

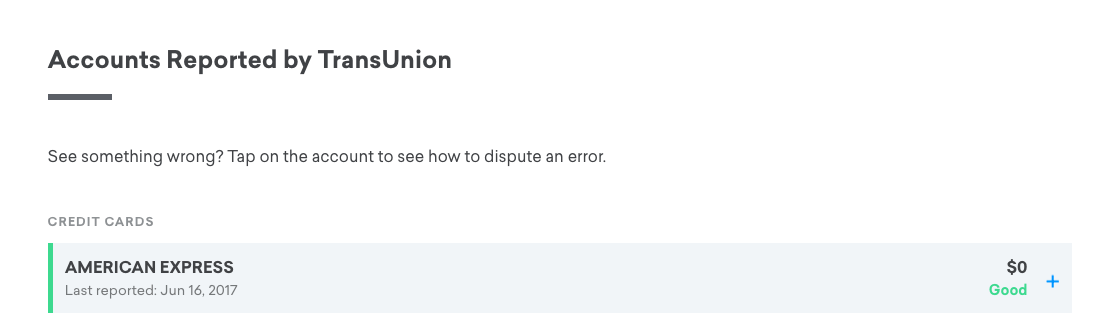

In my screenshot, I only have one account showing (the screenshot got cut off, but you will likely have several:

Alternate Step 2 if You Don’t Have an “Accounts” Tab

Thanks to reader, Garnet, for passing along these instructions. It seems like the “Accounts” tab isn’t visible for all users, especially if you just signed up for a CK account.

No “Accounts” tab? Do this…

1. After logging in, click the “Credit Reports” link in the left column of the page.

2. Scroll down the page; about half way down there is an Accounts section. At the bottom of that section, there are links to view accounts on both TransUnion and Equifax reports. You can click those links, or just above that there is a list of the type of accounts each credit union has a list of. You can click the word “credit card” in that list to view only your credit card accounts.

3. On the resulting screen, it provides a list of cards. To expand each one, click the arrow just to the left of each credit card name. The open date is displayed at the top of the info section.

Step 3: Expand an Account

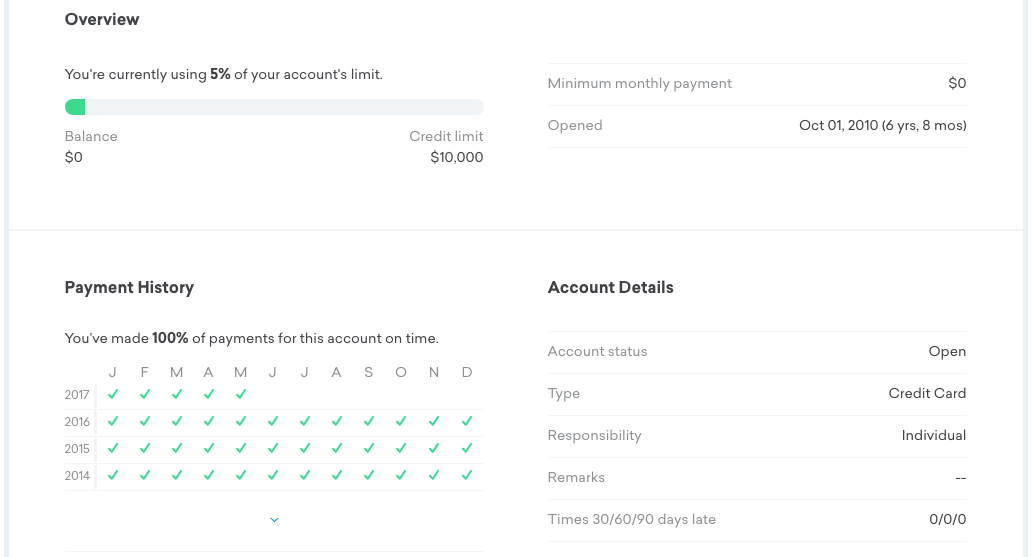

From there, you can click on the + sign to expand each line. That will open up a box with more detailed information about the selected credit account. And this is where our information is waiting!

Notice on the right hand side of this screen, under the line for “Minimum Monthly Payment” is a line called “Opened.” The date listed here is the date you opened the account.

Step 4: Repeat

Simply repeat this process for each account in the list on the Accounts page, and then record that data in your spreadsheet.

That’s it–as you can see it’s a very simple and speedy method!

Richmond Savers has partnered with CardRatings for our coverage of credit card products. Richmond Savers and CardRatings may receive a commission from card issuers.