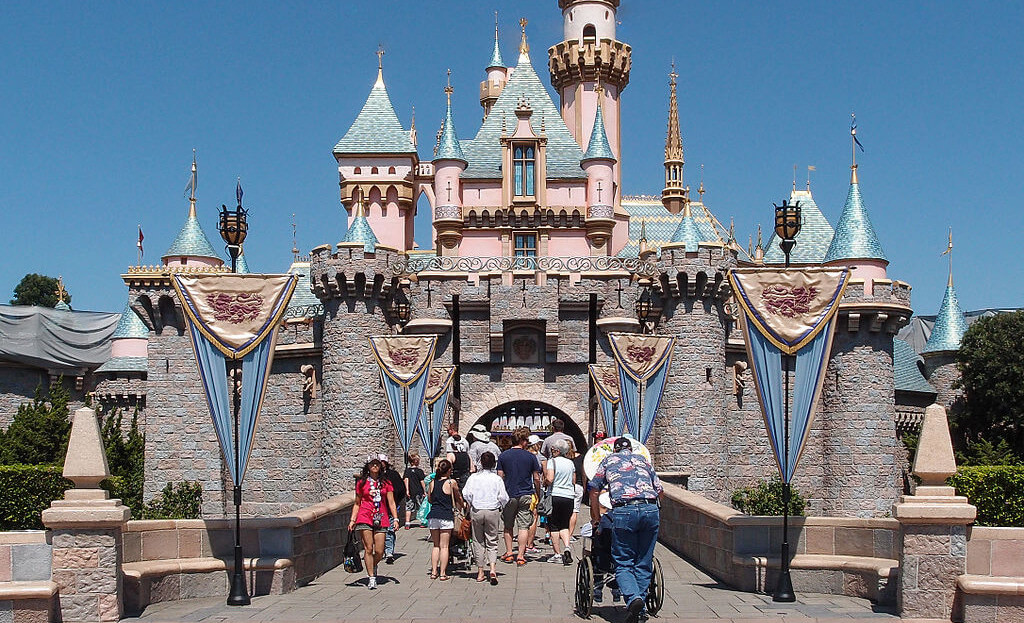

Our step-by-step guide on how to take a nearly free family trip to Walt Disney World in Florida using credit card rewards points has been featured in the NY Times, NBC, CBS and the Huffington Post. This article is a step-by-step guide to do the same for Disneyland in Anaheim, California!

You can save over $4,000 by following this guide and to make it happen you’ll need to open a few new credit cards to earn the significant signup bonuses on each card. Then you’ll use those signup bonuses for a nearly free trip to Disneyland!

Since you’re paying your credit cards off on time and in full every month this will cost you $0 in interest and the annual fees are even waived the first year on all the cards we recommend, so it really will cost you $0 to follow this plan. If you are responsible with your cards, we think you’ll find this a surprisingly easy (and fun!) way to save over $4,000 on your Disneyland family vacation!

We have a detailed guide for each major portion of the nearly free Disneyland trip using rewards points:

- Disneyland Park Tickets with Rewards Points

- Airline Tickets to Disneyland with Rewards Points

- Disneyland Hotel with Rewards Points

Disneyland Park Tickets with Rewards Points:

There aren’t any credit cards just for Disneyland park tickets, but we did the research and found a way to pay for your Disneyland tickets with rewards points anyway!

There aren’t any credit cards just for Disneyland park tickets, but we did the research and found a way to pay for your Disneyland tickets with rewards points anyway!

The Capital One Venture Rewards Credit Card lets you pay for “travel expenses” with your credit card and then log in to redeem those points to offset those purchases (or a portion) using your miles. Easy as that! Here’s the thing, buying tickets directly from Disney won’t work because they aren’t coded as a “travel expense.” But buying tickets from a certain authorized reseller will!

Our choice to purchase Disneyland park tickets is official authorized Disneyland ticket vendor aResTravel.com and since they are coded as a “travel agency” you can use your Venture miles. We personally spoke with two of their Vice Presidents and ran some test charges so we know this works.

If you and your spouse/significant other each open one of these credit cards and hit the spending requirements you’ll have at least $1,500 (realistically at least $1,660 since each of you will earn 8,000 miles for the $4,000 of minimum spending requirement. 8,000 miles = $80 of statement credits) in total travel statement credits available. You will need to each buy some of the Disneyland park tickets on each credit card account, so you’ll each have “travel expenses” to redeem your miles against.

aResTravel.com is highly recommended by MouseSavers.com so you know you can rely on them.

There is no shipping cost, so you can split your ticket purchase over these credit cards and it won’t cost you anything extra to do this. All you need to get started is the Capital One Venture card.

Capital One Venture Rewards Credit Card

Basics: The current offer is 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months after you open the account. There is a $95 annual fee. The bonus is worth $750 of free, flexible travel. (Plus, get $250 to use on Capital One Travel in your first cardholder year. So it can really be worth $1,000 in travel)

Favorite perk: We love that redemptions are incredibly simple. Just reimburse yourself for qualifying travel expenses by logging in and using your points to offset this expense. This is worth $750 for each card account (and each spouse can open one, potentially doubling the bonus miles)

Total Savings on Disneyland tickets: $1,500 (if both open the card )

Airline Tickets to Disneyland with Rewards Points:

Most people assume that LAX Airport is the easiest to use to visit Disneyland, but a friend of mine who lives in the area says the John Wayne Airport (airport code SNA) in Orange County is the closest and most convenient to get to Disneyland. A quick look at the SNA Airport Wikipedia page shows us that the biggest airline presence there is Southwest Airlines, which is ideal.

Important Note: The information for the Chase Sapphire Preferred® card has been collected independently by Richmond Savers. The product details on this page have not been reviewed or provided by the bank advertiser.

For most families, the easiest way to get your flights will be to each open a , which earns Ultimate Rewards (UR). These points are incredibly valuable since you can either use them to book travel directly through the online portal or you can transfer them to one of their rewards partners such as United, Southwest or British Airways where they become true frequent flyer miles in those programs.

For most families, the easiest way to get your flights will be to each open a , which earns Ultimate Rewards (UR). These points are incredibly valuable since you can either use them to book travel directly through the online portal or you can transfer them to one of their rewards partners such as United, Southwest or British Airways where they become true frequent flyer miles in those programs.

The current sign-up bonus is 100,000 points after reaching the minimum spending requirement of $5,000 (of your regular spending) in the first 3 months the account is open. There is a $95 annual fee.

You’ll each earn the 100,000 point bonus plus at least 5,000 points for your $5,000 worth of spending, so after meeting all the requirements you’ll have at minimum 105,000 points each.

If you each open this card and fulfill all the requirements as stated above you will now have at least 210,000 points and you have two main redemption options for your flights to Disneyland:

- The easiest and most flexible option allows you to purchase your flights through your online rewards portal. This is as simple as searching on any of your favorite online travel sites, so nothing difficult here at all! You will get 1.25 cents per point in value this way, which equates to $2,625 in free flights from your 210,000 points. That will give you a lot of flexibility to book on the airline of your choice and $2,625 should cover the vast majority of the flight expense for a family heading to Anaheim.

- The second option is to transfer these points to one of the partner airlines to book award tickets at that airline. You will want both spouses to send their points to one frequent flyer account and consolidate them there. Southwest Airlines is your best option by far since those miles are easy to use, and you likely will get more than $2,625 of value out of booking this way.

Southwest has no blackout dates and the award tickets are based on how much the flights cost, so this was the choice we made. We know many people who booked through the portal for simplicity and convenience, as it couldn’t be easier to book that way.

Total Savings on flights to California: $2,625 (or more!)

Disneyland Hotel with Rewards Points:

Disneyland’s website lists 41 “Good Neighbor hotels” they recommend for lodging near the park. We filtered by hotels under 1/2 mile from the park and we saw the Sheraton Park Hotel at the Anaheim Resort listed as a ‘superior’ hotel option.

Disneyland’s website lists 41 “Good Neighbor hotels” they recommend for lodging near the park. We filtered by hotels under 1/2 mile from the park and we saw the Sheraton Park Hotel at the Anaheim Resort listed as a ‘superior’ hotel option.

By opening 2 credit cards and putting your normal spending on them to earn the bonus, you have historically been able to earn enough points for at least five free nights at the Sheraton Park Hotel near Disneyland. (35,000 points per night, and the 5th consecutive night is free when booked with points). You can earn even more nights when there is a higher offer on the Marriott card. So far we’ve seen it fluctuate between 75,000 and 125,000 points. However, Marriott has recently changed the offer to a nights-based offer rather than a points-based offer, which makes it easy to earn six free nights.

Marriott Bonvoy Boundless® Credit Card

Important Note: The information for the Marriott Bonvoy Boundless® card has been collected independently by Richmond Savers. The product details on this page have not been reviewed or provided by the bank advertiser.

Important Note: The information for the Marriott Bonvoy Boundless® card has been collected independently by Richmond Savers. The product details on this page have not been reviewed or provided by the bank advertiser.

You and your significant other could each open a Marriott Bonvoy Boundless® Card. Earn 3 Free Night Awards (each night valued up to 50,000 points) after spending $3,000 on purchases in your first 3 months from account opening. Annual fee of $95 applies.

The other option is to supplement Marriott points/nights with your Chase Ultimate Rewards. We talk more about the Chase Sapphire Preferred® above, and it’s quite frankly the best travel card on the market, in our opinion. With the points from that card, you can transfer some of them to your Marriott account and book additional nights that way.

Total Savings for at least Five Free nights at a Disney hotel: ~$1,500 (assuming $300 per night cash value for 5 nights)

Summary:

You just learned how to use credit card rewards points to take a nearly free trip to Disneyland in California for up to nine nights including hotel, airfare and park tickets. By following the instructions in this article you can save $4,000+ on your family vacation to Disneyland.

You just learned how to use credit card rewards points to take a nearly free trip to Disneyland in California for up to nine nights including hotel, airfare and park tickets. By following the instructions in this article you can save $4,000+ on your family vacation to Disneyland.

Thanks,

Brad and Laura Barrett

Richmond Savers has partnered with CardRatings for our coverage of credit card products. Richmond Savers and CardRatings may receive a commission from card issuers.