Have you heard people talk about traveling the world for free with “points?” Or do you know someone who brags about getting a TON of cash back on almost every purchase they make? Maybe you’ve wondered how to get in on the action, but you assume that it’s too much of a time commitment or a strategy that’s too hard to implement.

Have you heard people talk about traveling the world for free with “points?” Or do you know someone who brags about getting a TON of cash back on almost every purchase they make? Maybe you’ve wondered how to get in on the action, but you assume that it’s too much of a time commitment or a strategy that’s too hard to implement.

Well, this guide is for you. In this post I’m going to explain credit card rewards in detail so that someone with absolutely zero knowledge of how this works can understand it and begin putting it into practice. Even if you already dabble in credit card rewards, you might find this useful, so I hope you’ll read along as well.

What We’ll Cover

Use the links below to jump ahead to a section.

One note: I’m going to dig into the finances behind this a little more than other bloggers. I want to make sure you understand that it’s absolutely critical for you to budget and pay off your bills in full each month.

To do this effectively, you should NEVER, EVER, EVER pay interest on your credit cards. When interest grows on credit cards, you pay more money than things are worth. That means you lose money.

This is only intended for people who don’t accrue interest on their credit cards, and that should be a non-negotiable consideration before moving forward. I’ll reiterate this a few more times later.

What’s Involved? A Word of Caution

Before we go any further, I want you to realize that credit card rewards don’t happen in a bubble. They don’t just magically appear in your account, and they don’t just grow and turn into free flights across the globe without any action on your part.

This can be hard work sometimes.

Ok, not really that hard–just an hour here and there. But the organization is ESSENTIAL. If you don’t take this hobby seriously, you run the risk of spending more money than you would otherwise. At that point, it wouldn’t be travel hacking anymore. Instead, the hobby would be hacking you and your financial goals.

The biggest concern is paying interest. To do this effectively, you should NEVER, EVER, EVER pay interest on your credit cards. When interest grows on credit cards, you pay more money than things are worth. That means you lose money. This hobby is about making and saving money, not losing it.

And the last thing we want is for people to start this hobby and end up hurting their finances as a result. So before you take this on, make sure that you can pay your cards in full every month, that you have emergency savings, and that you’re generally organized and budget-conscious. With those skills, you’ll be ready to do this hobby and do it well.

Step 1: Understand Your Credit

You also need to be aware of credit and how it works–we are talking about credit cards after all. There are two main things to be aware of here: 1) Where does your credit stand now? And 2) How will this hobby affect your credit?

Evaluate your current credit

If you aren’t sure exactly where your credit stands currently, you’ll want to figure that out before applying for new cards. Basically, you’ll want to check your credit report, and make sure that it is error-free. Plus, checking it will help you freshen up on any open accounts you have.

The best way to check this report is to use annualcreditreport.com. Don’t pay for a credit report if you can help it.

Annualcreditreport.com site gives you a report from each bureau (TransUnion, Equifax, and Experian). The first time you do this, it’s wise to review a copy from all three. After that, you can check each report for free every twelve months, which means that you can space them out for one free report every four months.

In addition to your report, you’ll want to know your credit score. This score is what’s used by the credit card companies when you apply, to decide whether or not to approve you for a card.

In most cases, you shouldn’t pay for a credit score. There are many ways to check this for free. You can use sites like Credit Karma (but you should know that they don’t use the same FICO score that most card companies do).

You might already have a credit card that allows you to check your score for fee. If so, check it there. If not, you might try Discover’s free service to check your FICO score.

At the end of the day, you’ll be aiming for a credit score of 750 and above. While not necessarily a hard and fast rule, this is the threshold at which you’re likely to be approved by the best cards.

How will this affect your credit?

Once you’ve assessed your credit, you might be wondering how opening new credit cards will affect it.

In general, opening new cards will have a positive effect on your credit utilization since you pay them off in full.

This is an interesting, and tricky, question. If you polled a group of credit card enthusiasts, I’m willing to bet that most would say they’ve experienced occasional dips in their credit scores but the long-term results have been positive.

The truth is, if your score is already above 750, and you follow the #1 rule of this hobby and never pay interest, then you’re probably going to be fine. You’d want to avoid new cards while preparing to apply for a mortgage, but other than that this should be smooth sailing.

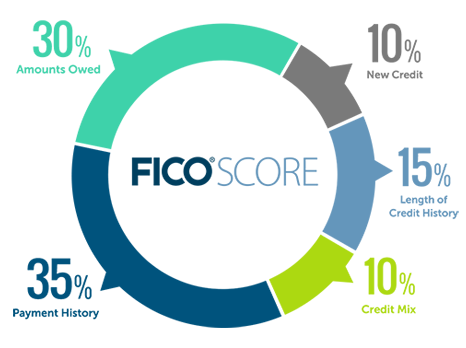

Source: myfico.com

Your FICO score is made up of five categories: payment history, amount owed, length of credit history, credit mix and new credit. As you can see, these are each weighted differently in the FICO model.

Three of these categories are most affected by pursuing rewards: amount owed, length of credit history, and new credit. The “bad news” is that every time you apply for a new card (assuming the company pulls your credit report), you will likely experience a ding of a couple points.

Also, any new account will lower your average age of accounts. While this might seem like purely “bad” news, it isn’t. Sometimes people choose to close cards later, and if you decide to close a card you recently opened (say after one year), then this impact disappears.

Lastly, the good news. As you open more accounts you will be adding to your overall credit limit. Since you won’t be paying interest or carrying a balance, this means that as a percentage you’ll be using less of your available credit.

How much credit you use is called your credit utilization, and it’s part of the section in your score called “amount owed.” In general, opening new cards will have a positive effect on your credit utilization since you pay them off in full.

Tax implications

We’ve covered the credit implications, but what about taxes? Here’s some more good news–credit card rewards aren’t generally taxable. That’s because they are viewed as “discounts” and not as income.

You should not have to worry about this with personal cards–but you can review your terms and conditions to see if IRS reporting is mentioned at all. On the off chance that your credit card issuer sends you a 1099, you will have to report that as income to the IRS–but this is extremely rare and almost entirely unheard of.

One other thing to know is that the rules for business credit cards are slightly different for tax purposes, as you may have to take into account any rewards on business expenses when you deduct those expenses on your tax return.

If this is relevant for you, you should speak to an accountant and get a professional opinion.

Step 2: Determine Your Goals

This might sound like a “fluff” step, but it’s actually quite important. You need to figure out exactly what it is that you want to accomplish–and then you’ll need to figure out the steps required to get you there.

Travel Points Only

Let’s start with scenarios focused mainly on travel.

For many people who take on this hobby, they have realized that travel is expensive but they are going to do it anyway. Sometimes it’s business travel, other times it’s a dream to see the world. And in some cases, it’s just the routine vacation(s) that they want to make more affordable.

From a mathematical perspective, it makes sense to replace that travel spending (out of pocket cash) with points, which can essentially be free.

If travel is a big line item in your budget, then this totally makes sense and will be a big game changer.

Pursuing Cash Back

On the completely other side of the spectrum, some folks just want to earn as much cash back as possible, so they can save more for retirement or pursue some other goal. If that’s the case, then there’s a slightly different group of cards you might apply for–and you might even take advantage of category bonuses more than signup bonuses.

If you fall in this camp, than you should know that this article is still 100 percent relevant for you, and it’s just as important that you understand how this process works. But you will likely implement a different strategy, mainly regarding the cards you open.

Mix of Cash and Travel

Then, there is a happy medium. These are the people who don’t travel that often or that routinely, but like the idea of it being free. Maybe you don’t have any trips planned currently, but you know that you’ll have to fly coast-to-coast for a friend’s wedding at some point, or that you’ve always wanted to visit the Greek islands.

Whatever the case may be, you know that travel rewards can help, and you’d like to have them for when the time comes.

In reality, the more concrete your travel plans are the easier it is to plan ahead for the points you want and the cards you’ll need to open. But the most important thing you can do is start thinking about what you hope to get from this strategy, so you can map out a long-term plan. Doing that will lead to the most efficiency in the long-term.

As you’re thinking about this, be sure to give some thought to how you want to travel as well. Are you looking for upgraded experiences like suites and first-class, or do you prefer to stretch your points further and get more stuff for free? It’s good to start thinking about this since it will affect your plans moving forward.

Step 3: Know Key Terms

If you’re new to travel rewards and you start to read blogs or talk to people about it, you will almost immediately get lost in a sea of jargon that you’ve never heard before. Below is a brief “dictionary” of key terms that you should be familiar with.

A signup bonus is an offer from a credit card company to award you with a number of points or miles if you meet the requirement(s). Typically the requirement is to spend a certain amount of money in a certain amount of time (usually three months). Here’s some example language from a recent signup bonus on the American Express Blue Cash Preferred credit card:“Earn $250 Back after you spend $1,000 in purchases on your new Card in your first 3 months of Card Membership. You will receive the $250 back in the form of a statement credit.”Minimum Spend

Minimum spend is the amount of purchases you’ll need to make in order to earn a signup bonus. In the example above, the minimum spend is $1,000. On most “high profile” credit card bonuses, the minimum spend is between $3,000 and $4,000.Category Bonus

A category bonus provides increased earnings, in the form of points or cash back, when you use your credit card to make purchases in the specified category. A credit card typically has a baseline earnings rate of 1-2 percent on every purchase, but the category bonus is sometimes much higher. In many cases, cards impose a limit for the earnings (ie only on spending up to $1,000 in that category), and in some cases cards use quarterly categories.

Co-branded cards also often use category bonuses when you spend money on their company (ie, you might earn 5x the points on purchases at a hotel when you use the hotel’s co-branded card).

Here’s an example, again from the American Express Blue Cash Preferred:

“EARN 6% CASH BACK at US supermarkets, up to $6,000 per year in purchases (then 1%). Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit.”

Annual Fees

An annual fee is assessed by credit card companies on certain products (cards). Often, cards with annual fees provide a more robust suite of benefits for card members (lounge access, additional travel credits, etc.).

In some cases, annual fees are waived for the first year you have the card. This is the case on quite a few popular cards. Because of that, one question we often receive from readers is whether they should (or whether “it’s OK to”) close an account before the annual fee is charged.

This will come down to your personal preference. There is nothing wrong with cancelling a card before the fee is due, and that is your consumer right. However, many cards offer benefits that make paying the annual fee worth it to some cardholders. You will need to assess your travel habits and goals to make this determination.

Authorized User

An authorized user is a person added to a credit card account and issued his or her own card. Some signup bonuses include additional incentives to add an authorized user (ie you’ll receive more points if the authorized user makes a purchase(s) in the stated time period). However, due to recent changes by some creditors which make it harder to get approved for cards if you have opened multiple cards recently, we don’t typically recommend that you use the authorized user strategy with someone who hopes to apply for more cards. When you’re an authorized user, that is listed on your credit report as an active account.

In other words, if two spouses are both planning to pursue rewards and open a few cards, they shouldn’t make each other the authorized user on their accounts, because doing so will make it harder to get more cards. Adding a different family member may be a useful option, though.

Targeted Offer

A targeted offer is an increased bonus offer sent to certain individuals by mail or email. This offer is typically higher than the publicly available offer at the time. Note: just because you received a targeted offer does not mean that you will automatically be approved for the card.

Reconsideration Line

A reconsideration line (recon) is a division of a credit card’s customer service department, reached by phone, that has the power to review your application and potentially overturn a denied application.

Bank Bonus

A bank bonus is an offer from a bank to receive a cash reward for opening a new account(s). Typically, there are other requirements, such as setting up direct deposit and maintaining a minimum account balance.

Rewards from bank accounts are typically taxable, as they often report the bonuses as income.

These are virtually entirely separate from credit card rewards, but they are good to be familiar with, especially as some provide an opportunity to fund with credit cards.

Redemption

A redemption occurs when you use your points or miles. You can redeem some rewards directly to offset a cost (ie a travel credit or cash back statement credit), you can redeem some by transferring them to partners (where you then redeem the points again in their new currency), or in some cases you can directly redeem them for travel, cash or gift cards, etc.

Taxes, Fees, other Charges

When you book with points, you frequently will still pay some taxes and fees. With hotels, these are minimal. If you pay for a hotel in full with points, taxes and fees are often waived. One exception is that resorts will still charge a resort fee that isn’t covered with points.

Airlines on the other hand, operate differently. You will encounter taxes and fees when using points for flights. While often small, you’ll want to be on the lookout for fuel surcharges or anything labeled as a “carrier imposed surcharge.” These can be quite large and quickly eliminate much of the savings you would earn with a points redemption.

Anniversary Night

An anniversary night is a free night to a property within a hotel chain offered by their co-branded card. Typically, these cards have annual fees, and the free night can be thought of as offsetting the annual fee. The redemption is often limited to a particular group of hotels by category (ie Category 1-4), but presents solid value. Also, resort fees are typically waived for this type of redemption.

Credit (ie “Travel” Credit)

A credit is an amount of money applied directly to your account from the credit card issuer. These typically reimburse you for a qualifying purchase. A simple example would be the $30 in-flight WIFI credit offered on the Discover It Miles – Unlimited 1.5x Rewards Card.

If you make a purchase for in-flight WIFI, up to $30, Discover will issue a credit to your account, covering this cost.

Points Valuation

A points valuation is a representation of how much your points are worth in cash terms. As you’ll see in a second, some points have a fixed value, so redemptions with those points will also always have a fixed valuation.

However, when points are more flexible, they will open up the possibility of getting better valuation. For example, if you could transfer 5,000 points to Hotel Chain A to stay at a $200 room for free, your points would have a value of four cents per point. But what if you could use those same 5,000 points to transfer to Hotel Chain B and stay in a $300 room for free?

In that case, your points valuation would be six cents per point. The higher the valuation, the better.

One word of caution, though. Remember step two about defining your goals? That should be the leading factor for most people. Getting a better valuation at the expense of more points could cost you more money in the long-term.

Maybe you’d rather spend more points to stay at a nicer place (even with a better valuation), but there is an opportunity cost (something you’re forfeiting). In this example, it could be that you’re giving up points that could be used for multiple nights at a hotel in order to receive a single night in a nicer hotel.

You’ll have to use discretion and think through your own goals. Some travelers look at valuation as a game, always trying to get it higher and higher. That’s great in some cases! But remember to make your points work for you and achieve your goals.

Fixed-Value Cards

Fixed-value credit cards earn points that are redeemed at a set, unchanging rate (usually once cent per point). This means that 40,000 points would be worth $400. On one hand, these are incredibly straightforward and simple to use (which makes them great for beginners). On the other hand, they aren’t as valuable as transferable points, which can often be redeemed at better rates.

Keep in mind, fixed-value cards still offer great signup bonuses. For example, our favorite fixed-value credit card is the Capital One Venture. If, for instance, the bonus offer is 60,000 miles, you’ll have $600 worth of flexible travel! You won’t care too much about the redemption rate at that point!

So just because the redemption rate isn’t as high with fixed-value cards does not mean that you should ignore them.

Co-branded Cards

Co-branded credit cards are offered in partnership between credit card companies and travel companies, like hotels and airlines. One example would be the Starwood Preferred Guest® from American Express (see our review here).

The limiting factor of these cards is that they often only allow you to use your points in one way (with the specific airline or hotel). But some, like with the SPG card, allow you to transfer to other partners).

Perhaps the biggest perk of this type of card is that as you earn points (from a signup bonus and after), those points are stored in the airline or hotel account. They become totally separate from your credit card account, which means if you close the account later you will not lose the points.

Transferable Points Cards

Transferable points credit cards allow you to use your earnings in a variety of ways by transferring them to other partners, such as airlines and hotels. You can see that this provides more flexibility than a co-branded card because you get access to multiple travel partners. A classic example of this type of program is Amex Membership Rewards.

One downside to this type of card is that your points are directly tied to your credit account. That means if you close the account, you can lose any remaining points. But there are workarounds! You could simply ensure that you transfer all your points before closing the account, or if you have an additional card within the same transferable points program, you can transfer the points from the card you are closing to one that you will keep open.

Loyalty Programs

Loyalty programs are offered by all the large airlines and hotels. You’ll earn points with these programs every time you fly or stay with them, and they are also where your points will go if you transfer to them or open a co-branded card with them.

It’s a good idea to set up your loyalty programs with companies you use most frequently–and to ensure that you squeeze all the points you can from them.

Processing Fees

Credit card processing fees are charged by come merchants when you pay with a credit card. These sometimes come into play, often when trying to meet minimum spending requirements, as you have to decide whether the fee is worth it for the points earned.

Plastiq

Plastiq is a service that allows users to pay with a credit card for purchases that typically don’t accept credit card payments. Essentially, the user pays Plastiq, which then pays the bill on behalf of the user. This is commonly done with mortgages, utilities, daycares, and other large expenses where credit cards are typically off the table.

Because Plastiq charges fees, this strategy is often reserved for working on minimum spending requirements. However, Plastiq could also be used in conjunction with a card like the Discover It Miles – Unlimited 1.5x Rewards Card during the first year of card ownership. That’s because the card earns 1.5 percent, which is then matched at the end of the year by Discover (so, 3 percent total). The total three percent exceeds the Plastiq fee, so there is a net profit.

Cash Back Portals

Cash back portals are websites that pay a user cash back if they visit the portal first, and then proceed to a qualifying website through the portal and make a purchase. The most popular such portals are Ebates and TopCashBack. The baseline earnings is one percent, but you can often find deals that are much higher and can save you significantly.

When you combine this strategy with earning rewards, you are “double dipping” or “stacking” your savings.

Gift Card Buying

Buying gift cards from websites like raise.com is similar to using a cash back portal in the sense that it saves you money in addition to the credit card rewards you earn. Gift card resellers list discounted gift cards to popular restaurants and retailers. The rates will vary based on the popularity of the company.

As an example, let’s say you needed to buy a washing machine from Home Depot. This large purchase is a good candidate for helping you meet a minimum spending requirement. However, you also want to save as much money on the purchase as possible.

So, you might buy a discounted Home Depot gift card online using your credit card. That way, you’re still putting significant spend on your card, while also keeping your overall cost down.

Step 4: Know the Rules and Have a System

Ok, so let’s talk about rules and organization.

What I mean by “rules” here though are the little “gotchas” that you need to be aware of. And to really be proactive, you need a system to stay organized.

I’ve touched on some aspects of “rules” already–things like being sure to review the terms and conditions of your cards.

What I mean by “rules” here though are the little “gotchas” that you need to be aware of. And to really be proactive, you need a system to stay organized. Here’s the exact spreadsheet Brad and Laura used when they took their family to Disney World for free.

This spreadsheet alone is enough to help you get organized (yeah, it’s Disney-focused but you can simply tweak it and replace the fields with your info as necessary). It provides columns to track all the items that you need to keep up with, like when annual fees kick in and where you can log in to your accounts. Having all of this information in one place will save you a lot of frustration and help ensure that you don’t waste money by not paying attention to your accounts.

You might want to try a service like AwardWallet than can help with this organization.

You’ll also want to familiarize yourself with rules from the credit card issuers. Different issuers have different policies/procedures on topics such as:

- Whether they’ll approve you if you’ve opened lots of cards recently

- How many times you can open/close/reopen the same card

- How likely they are to send you a targeted offer that’s better than the standard offer

In a short, supplementary post, we’ve tried to cover the basics and most essential rules for each major card issuer.

Step 5: Assess your Comfort Level

The reason you’ll want to stay organized and be aware of the bigger picture “rules” is that these will help you determine your comfort level moving forward.

Some people will be comfortable with moving at lightning speed–opening a bunch of cards in single fell swoop.

Other folks are going to want to take it slow. Maybe they only want to open a couple of cards this year for a family vacation.

Either way is absolutely fine. You need to move at the speed that is right for you. Whatever you do, just stay organized.

Step 6: Look for Offers and Apply

Once you understand the basics of how this all works, you’re ready to start looking at offers and applying for the card(s) that aligns with your goals.