Are you considering a European vacation? Many folks dream of going to Europe because of it’s rich history, popular attractions and unique flavors. However, for many people, it’s just that–a dream. The cost of flights, transportation and hotel stays are expensive and are a total buzzkill when trying to plan a trip. But why not make that dream a reality without breaking the bank? Leveraging credit card rewards wisely could significantly drop the price of your flights and hotel stays to free, or almost free. You can afford free, right? Let’s go!

Are you considering a European vacation? Many folks dream of going to Europe because of it’s rich history, popular attractions and unique flavors. However, for many people, it’s just that–a dream. The cost of flights, transportation and hotel stays are expensive and are a total buzzkill when trying to plan a trip. But why not make that dream a reality without breaking the bank? Leveraging credit card rewards wisely could significantly drop the price of your flights and hotel stays to free, or almost free. You can afford free, right? Let’s go!

London: A Top Destination, but an Expensive One

London is a major leader worldwide in business, fashion, art, education and more! And as a result it’s both one of the most popular destinations for travelers in Europe and one of the most expensive cities in the world.

Luckily, there is plenty to do while there. You can take one of many tours in London–to check out Big Ben, Westminster Abbey, the London Eye and more. If you’re a soccer buff, London has several professional teams that you could go watch, and encounter the strong passion that the city has for their teams. Or maybe London is just a quick stop on a grand tour of Europe. Whatever you do, you’re sure to find something to engage your interests in this magnificent city.

Getting to London

So let’s talk about airfare for a minute. Doing a quick search on flights, the cheapest that I found for next month from my hometown to London would be around $1300 round trip for one ticket. From larger cities, you can find round trip flights for around $800, and if there are some sales going on you can find them cheaper. We can do better than that though using points. For 20,000 Alaska Airline miles and about $24 in fees, you can fly one way to London on American Airlines! These mileage rates are during off-peak season. During peak season, those same flights are 30,000 miles. For a round trip off-peak flight that would be a great deal of just 40,000 Alaska Airline miles!

You could also save up your American Airline miles as it would cost 22,500 miles one way during off-peak season, or 30,000 miles during peak season.

Did you notice how I mentioned peak and off-peak rates? It pays to be flexible with your travel plans in order to save on miles. You pay less miles when traveling during off-peak dates with some airline loyalty programs. The mileage savings could really add up, especially if there are more passengers traveling with you on award flights. We mentioned this concept in our guide to Italy.

Staying in London

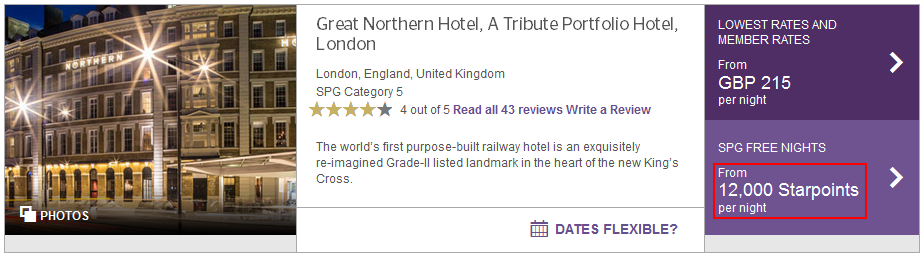

Note: this article was written before the Marriott and Starwood merger. Another potentially expensive part to any trip is your hotel stay. In a city such as London, you could easily spend $300-$500 a night at a hotel. That’s a major leak in a person’s travel budget. The good thing is that you can use hotel points to cover your nightly stays. A wonderful option to use is SPG. Starwood’s loyalty program offers some great award stay opportunities where you can really stretch your points. Here are some options.

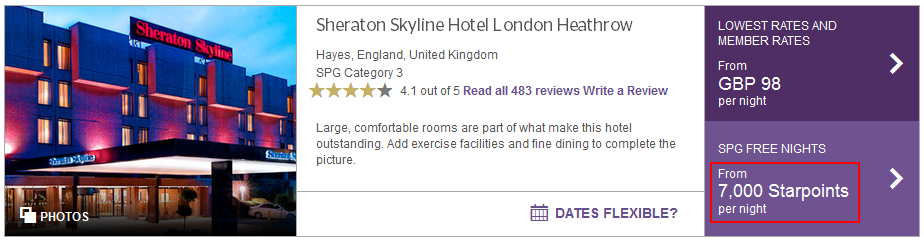

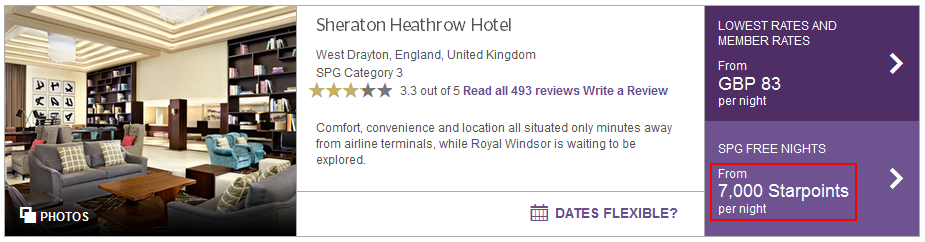

If you’re looking to stay close to the airport, then there are a couple of options that run for 7,000 Starpoints per night:

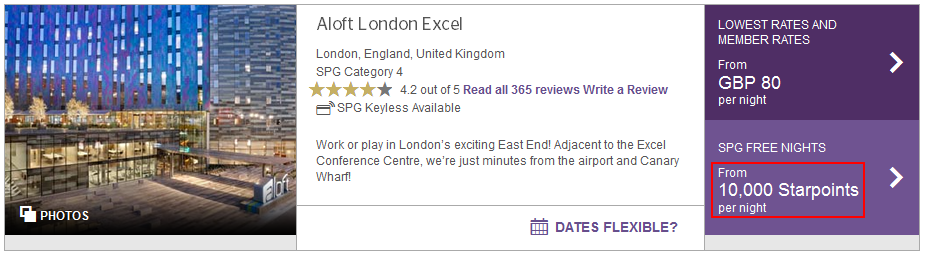

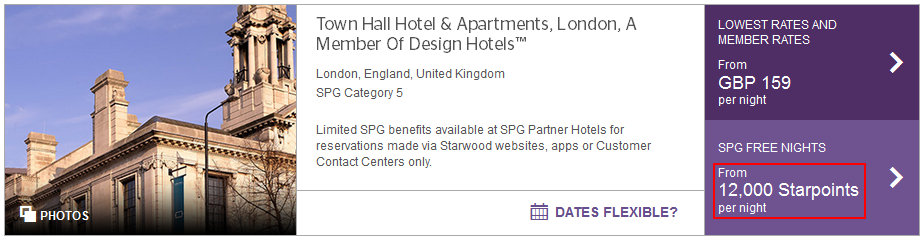

If you are wanting to stay elsewhere in the city, here are a few other options that will not run you a lot of points.

One great thing about the SPG program, which we mention in our review, is their 5th night free benefit. What this means is if you redeem points for 5 consecutive nights at one of their category 3-7 hotels, then you will only be charged points for 4 nights, resulting in one free night. If your nightly stay costs 10,000 Starpoints, then instead of paying 50,000 Starpoints for a 5 night stay, you would only pay 40,000 Starpoints for a 5 night stay. This helps to stretch your points out even further!

Other Travel Expenses

So now that your flight and hotel stay is covered, what about incidental travel related expenses? Things such as the cost of ride sharing services, taxis, train tickets, tours, etc could add up and blow your budget. Don’t forget to account for these expenses. The great thing is that these type of expenses could be covered by flexible points such as with the Capital One Venture Rewards Credit Card (see our review here). Currently, these bonuses are very generous and are great deals that can help cover all the incidentals you will encounter along the way!

Conclusion

As you can see, it is possible to cover your airfare, hotel stays and other travel related expenses with credit card points and miles. We highlighted how each type of points or miles has their place when planning for travel. This by no means is the only way to utilize points or miles for your trip. You can mix or match them however you see fit–or you may choose different hotels/airlines. What is important to understand is that points or miles take a huge chunk out of the cost of traveling,leaving you more cash for souvenirs! With a smart game plan, flexible travel dates and a diverse balance of points you can go to London and enjoy yourself without worrying too much about the cost.

Richmond Savers has partnered with CardRatings for our coverage of credit card products. Richmond Savers and CardRatings may receive a commission from card issuers.